Charitable Donation Appraisals

Legacy Donation Appraisers provides USPAP-compliant, IRS-qualified appraisals for claiming charitable tax deductions and filing IRS Form 8283.

- USPAP-Compliant & IRS-Qualified Appraisals

- IRS Form 8283 included

- Secure a tax deduction for your non-cash charitable donations

Start your IRS-qualified appraisal

Get a quick response from our team

Supporting our clients with donations to the largest DAFs, universities, museums, and nonprofit organizations in the United States

IRS-Qualified Appraisals of Personal Property, Equipment, Business Interests, and more

Legacy Donation Appraisers are experts in IRS Form 8283 appraisals for tax deductions and offers appraisal services across major asset categories.

Personal Property Appraisals

Appraisals of furniture, jewelry, watches, collectibles, antiques, luxury goods, clothing, decorative arts, and household inventory. Commonly transferred to community foundations, universities, religious institutions, and national nonprofit organizations.

Fine Art Appraisals

Appraisals of paintings, prints, sculpture, photography, and mixed media by Old Master, Impressionist, Modern, Post-War, and Contemporary artists — including blue-chip, mid-career, and emerging names. Often placed with museums, universities, and cultural institutions.

Machinery & Equipment Appraisals

Appraisals of manufacturing equipment, construction machinery, restaurant equipment, medical devices, agricultural equipment, and specialized tools. Often transferred to technical schools, workforce programs, nonprofit operators, and international aid organizations.

Business Valuations

Appraisals of privately held business interests, including S Corps, C Corps, LLCs, ESOP-owned companies, real estate holding companies, partnership interests, and professional practices. Typically assigned to donor-advised funds, private foundations, and major nonprofit institutions.

Inventory Appraisals

Appraisals of retail and wholesale inventory, including food inventory, clothing and apparel inventory, raw materials, finished goods, overstock, excess stock, and liquidation inventory. Commonly transferred to foundations, nonprofit distributors, educational institutions, and community-based organizations.

Bullion & Precious Metal Appraisals

Appraisals of gold, silver, platinum, bullion bars, investment-grade coins, and precious metal holdings. Often allocated to private foundations, religious institutions, community charities, donor-advised funds (DAFs), and endowment funds.

Vehicle Appraisals

Appraisals of cars, trucks, SUVs, classic vehicles, boats, RVs, motorcycles, and specialty vehicles. Commonly transferred to veterans organizations, educational institutions, environmental nonprofits, and national charity programs.

Cryptocurrency Appraisals

Appraisals of digital assets including Bitcoin, Ethereum, stablecoins, NFTs, and other blockchain-based holdings. Frequently directed to universities, donor-advised funds, global nonprofits, and technology-focused organizations.

About Legacy Donation Appraisers

Legacy Donation Appraisers specializes in qualified appraisals of assets contributed as part of charitable planning and structured giving strategies. We work closely with high-net-worth individuals, business owners, family offices, registered investment advisors (RIAs), financial planners, CPAs, and attorneys to support the accurate reporting of significant non-cash contributions.

Our appraisals are prepared in accordance with the Uniform Standards of Professional Appraisal Practice (USPAP) and are structured to satisfy IRS requirements for a Qualified Appraisal when applicable. For noncash charitable contributions that require formal substantiation, we routinely complete and sign Part IV (Appraiser Declaration) of IRS Form 8283, Section B.

We regularly support complex donation structures, including contributions to donor-advised funds (DAFs), private foundations, charitable remainder trusts (CRTs), charitable remainder unitrusts (CRUTs), and charitable gift annuities. These transactions often involve substantial or illiquid assets requiring careful fair market value analysis and defensible reporting.

Assignments are performed by credentialed appraisers holding respected professional designations such as ISA, ASA, and AAA, with subject-matter expertise across fine art, tangible personal property, business interests, inventory, machinery and equipment, vehicles, digital assets, and precious metals. Each engagement is handled with independence, documentation discipline, and attention to regulatory standards appropriate for high-value transfers.

Legacy Donation Appraisers is committed to delivering credible, well-supported fair market value opinions when compliance, accuracy, and professional standards matter most.

IRS Form 8283 Appraisals Required for Large Non-Cash Charitable Donations

Comprehensive qualified appraisals determining fair market value for non-cash donations exceeding $5,000, developed under USPAP standards and aligned with IRS Form 8283, Section B requirements.

What is IRS Form 8283?

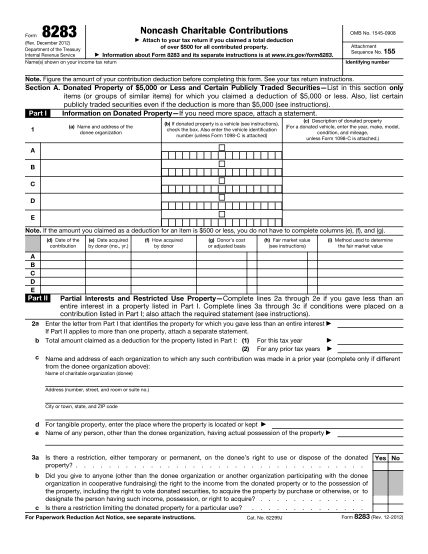

IRS Form 8283, Noncash Charitable Contributions, is required when a taxpayer claims a deduction for donated property exceeding $500, and it becomes significantly more detailed when the value of donated non-cash property exceeds $5,000.

For contributions over $5,000 (other than certain publicly traded securities), the IRS generally requires a Qualified Appraisal prepared by a qualified appraiser. In these cases, the donor must complete Section B of Form 8283, and the appraiser must complete and sign Part IV (Appraiser Declaration) to confirm the appraisal meets IRS standards.

Legacy Donation Appraisers Performs 8283 Appraisals

Legacy Donation Appraisers are experts in preparing qualified appraisals for filing of IRS Form 8283. We work with donors and their advisors to establish defensible fair market value in accordance with USPAP and IRS requirements, including support for Form 8283, Section B reporting and the appraiser declaration in Part IV.

Our credentialed appraisers provide valuation support across major asset categories, including:

- Personal Property Appraisals

- Fine Art Appraisals

- Machinery & Equipment Appraisals

- Business Valuations

- Inventory Appraisals

- Bullion & Precious Metal Appraisals

- Vehicle Appraisals

- Cryptocurrency Appraisals

Whether the asset is readily marketable or complex and illiquid, we provide independent, well-supported fair market value opinions designed to withstand scrutiny and support proper charitable reporting.

5-Star Service

Frequently Asked Questions

When is a qualified appraisal required for a charitable donation?

A qualified appraisal is generally required when a taxpayer claims a deduction of more than $5,000 for non-cash property other than certain publicly traded securities. In these cases, Section B of IRS Form 8283 must be completed and a qualified appraiser must sign Part IV Appraiser Declaration.

Additional requirements apply in situations including:

- Artwork valued at $20,000 or more which requires a complete signed appraisal attached to the return

- Donations of $500,000 or more which require the complete signed appraisal attached

- Clothing or household items not in good used condition valued over $500

- Groups of similar items that collectively exceed $5,000 even if donated to different organizations

What is IRS Form 8283?

IRS Form 8283, Noncash Charitable Contributions, is used to report non-cash donations exceeding $500. When the claimed deduction exceeds $5,000, Section B must be completed and supported by a qualified appraisal prepared in accordance with Treasury Regulations and USPAP standards.

The form documents:

- A description of the donated property

- The date acquired and date donated

- The manner of acquisition

- The fair market value

- The donee acknowledgment

- The qualified appraiser declaration

Proper completion of Form 8283 is essential to substantiate a charitable deduction and reduce audit risk.

What assets does Legacy Donation Appraisers appraise?

We prepare qualified appraisals for a wide range of donated assets, including:

- Personal Property including furniture, jewelry, watches, collectibles, antiques, luxury goods, clothing, decorative arts, and household inventory

- Fine Art including paintings, prints, sculpture, photography, and mixed media by Old Master, Impressionist, Modern, Post-War, Contemporary, blue-chip, mid-career, and emerging artists

- Machinery and Equipment including manufacturing equipment, construction machinery, restaurant equipment, medical devices, agricultural equipment, and specialized tools

- Business Interests including S Corps, C Corps, LLCs, ESOP-owned companies, real estate holding companies, partnership interests, and professional practices

- Inventory including food inventory, clothing and apparel inventory, retail and wholesale stock, raw materials, finished goods, overstock, excess stock, and liquidation inventory

- Bullion and Precious Metals including gold, silver, platinum, bullion bars, investment-grade coins, and precious metal holdings

- Vehicles including cars, trucks, SUVs, classic and collector vehicles, boats, RVs, motorcycles, and specialty vehicles

- Cryptocurrency including Bitcoin, Ethereum, stablecoins, NFTs, and other blockchain-based digital assets

If your asset type is not listed, our team can confirm whether a qualified appraisal is required under IRS guidelines.

What makes an appraisal qualified for IRS purposes?

A qualified appraisal must meet specific requirements under Treasury Regulations Section 1.170A-17. The appraisal must:

- Be prepared in accordance with the Uniform Standards of Professional Appraisal Practice USPAP

- Be completed by a qualified appraiser as defined by IRS regulations

- Include a detailed description of the property and its condition

- State the valuation effective date

- Explain the valuation methodology used

- Provide the appraiser’s credentials and declaration of competency

- State the fair market value as defined under Reg. 1.170A-1(c)(2)

- Be prepared for income tax purposes

These standards are designed to ensure independence, transparency, and defensibility.

Who qualifies as a qualified appraiser?

Under IRS regulations, a qualified appraiser must:

- Hold recognized appraisal credentials or meet required education and experience standards

- Regularly prepare appraisals for compensation

- Demonstrate competency in valuing the specific property type

- Provide their taxpayer identification number

- Not be the donor, donee, or a related party

- Not charge a fee based on a percentage of the appraised value

Legacy Donation Appraisers works with credentialed professionals holding recognized designations such as ISA, ASA, and AAA.

How many IRS Form 8283s are required?

A separate Form 8283 must generally be prepared for each donee organization receiving donated property. If similar items donated to multiple organizations collectively exceed $5,000 in value, Section B reporting may still be required. Each donee organization must complete and sign the Donee Acknowledgment portion of the form.

What are the timing requirements for a charitable donation appraisal?

The appraisal must be performed no earlier than 60 days before the date of contribution and no later than the due date including extensions of the tax return on which the deduction is first claimed. If the donation occurs outside the 60-day window from the appraisal date, the report may need to be updated to reflect the correct valuation effective date.

Do you offer rush appraisal services to meet tax deadlines?

Yes. We understand that many charitable contributions occur near tax filing deadlines. When timing is critical, we offer expedited appraisal services to help donors and advisors meet IRS filing requirements, including support for Form 8283 Section B. Rush availability depends on asset type, complexity, and documentation readiness, so early coordination is recommended.

How long does the appraisal process take?

Turnaround time depends on the type of asset, complexity of the assignment, and completeness of documentation provided. Many standard assignments are completed within several business days, while complex or high-value assets may require additional time for research and analysis. We coordinate closely with donors and advisors to meet reporting deadlines whenever possible.

How much does a qualified appraisal cost?

Pricing varies based on asset type, number of items, complexity, and reporting requirements. Factors that influence fees include:

- Asset category and valuation complexity

- Number of items or interests being appraised

- Section B reporting requirements

- Need for additional documentation such as artwork valued at $20,000 or more

- Business or illiquid asset analysis

We provide transparent fixed-fee quotes prior to engagement so clients understand costs upfront.